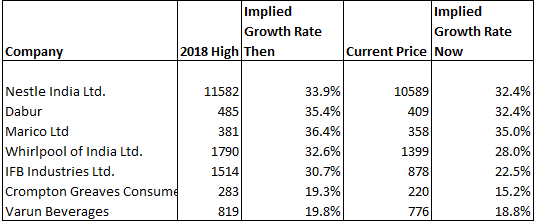

This is a followup to our previous blog where we had presented the implied growth rates in some companies stock prices. Given the good response that we got, we have decided to run a small screen on implied growth rates every week on Thursdays.

Please do send in your requests if there is a specific company/space where you want us to run this.

The only rule for this screen is

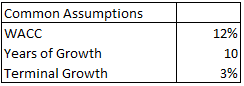

Same macro assumptions for all – WACC of 12%, terminal growth 3% and 10 years of growth. In the last blog, we used 15% WACC, but that seems high in the current context. Nonetheless we want to treat all companies to a similar discount rate and macros for sake of simplicity. One can obviously go back to our site and use it to test for more company specific Cost of Capital and other parameters to assess the fair values.

For this blog we have chosen a mix of consumer companies, showing the variations between various segments there.

Related Blogs

THE NUMBERS GAME (PART 2)

In the previous blog we talked about information g....

Udit Garg

13/01/2017 12:00 AM

THE FANTASTIC STORY THAT IS INDIAN EQUITY MARKETS

Despite this we have only models for less than 20%....

Udit Garg

13/01/2017 12:00 AM