I was just putting in place our Excess Returns based valuation model tools for the financials companies, when my developer, who is btw a finance novice, asked if it was only a theoretical valuation for the company!

We all know that there is a wide gap in theory and practice anyways, especially in finance. So it came as a pleasant surprise when I met a fund manager who was extremely interested in knowing about implied growth rates at current prices and another who actually chased us to improve the outputs that we show in DCF.

So what is happening here, some of the best guys in finance looking at the most basic and boring of the concepts in finance? Well this usually happens when frenzy takes a break and Buyers sit back and think on what they are actually paying for the stock of any company. Although largely academic in nature, markets do eventually revert back to reasonably accurate assumptions as per DCF values.

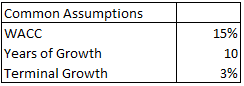

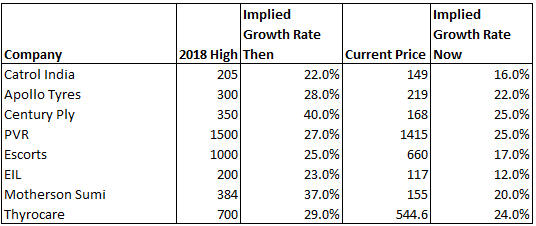

After my interactions, I asked a team mate to perform a basic Implied Growth Analysis on a few companies. Here is a short summary of it. While a WACC at 15% might be high for some people, I for one thought that most stocks were sitting at pretty heavy growth expectations.

Related Blogs

THE NUMBERS GAME (PART 2)

In the previous blog we talked about information g....

Udit Garg

13/01/2017 12:00 AM

THE FANTASTIC STORY THAT IS INDIAN EQUITY MARKETS

Despite this we have only models for less than 20%....

Udit Garg

13/01/2017 12:00 AM