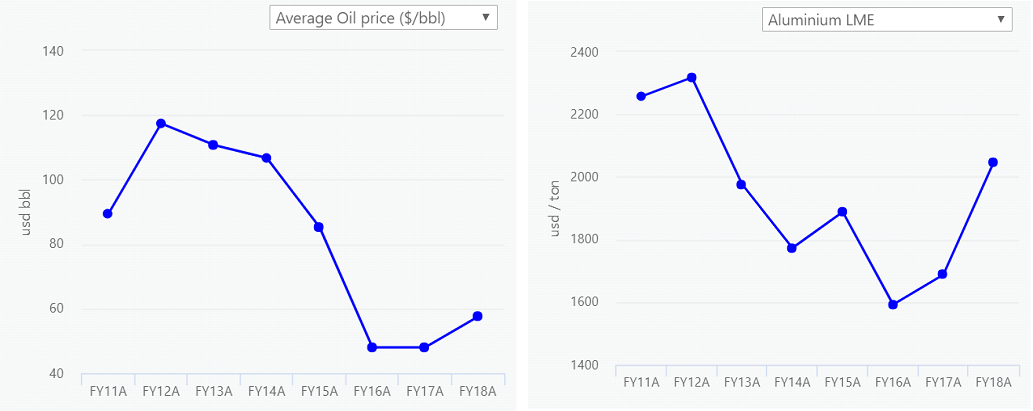

I have been thinking a lot about this – if as an economy we (as in India!) benefited from the low commodity prices over the past 5 years, would it not be an issue for us if commodity prices sustain at the current levels. For example, Oil prices broadly averaged US$50/barrel in 2015/16/17, Aluminium averaged US$1700/ton and similarly for other commodities. Both these commodities have now significantly higher prices (Oil at US$75/barrel and Aluminium at US$2100/ton).

Unlike Brazil or Australia which are largely commodity linked markets, India is a consumer economy which relies on most commodities going in as inputs to feed the rising demand. As an economy which imports these commodities, it meant that we had to pay less externally and various parts of the economic system benefited.

- Government benefited by using the subsidy savings to fund welfare schemes and lower the fiscal deficit targets, thereby controlling the inflation in the economy.

- Several manufacturing sector companies were able to use the prices comfort to expand margins thereby improving the profitability.

- Consumers benefited as low inflation, coupled with still rising wages meant that purchasing power improved, thereby boosting consumption.

- Most importantly stock markets rallied as several companies saw high consumption growth and cycle high profitability margins come through at the same time.

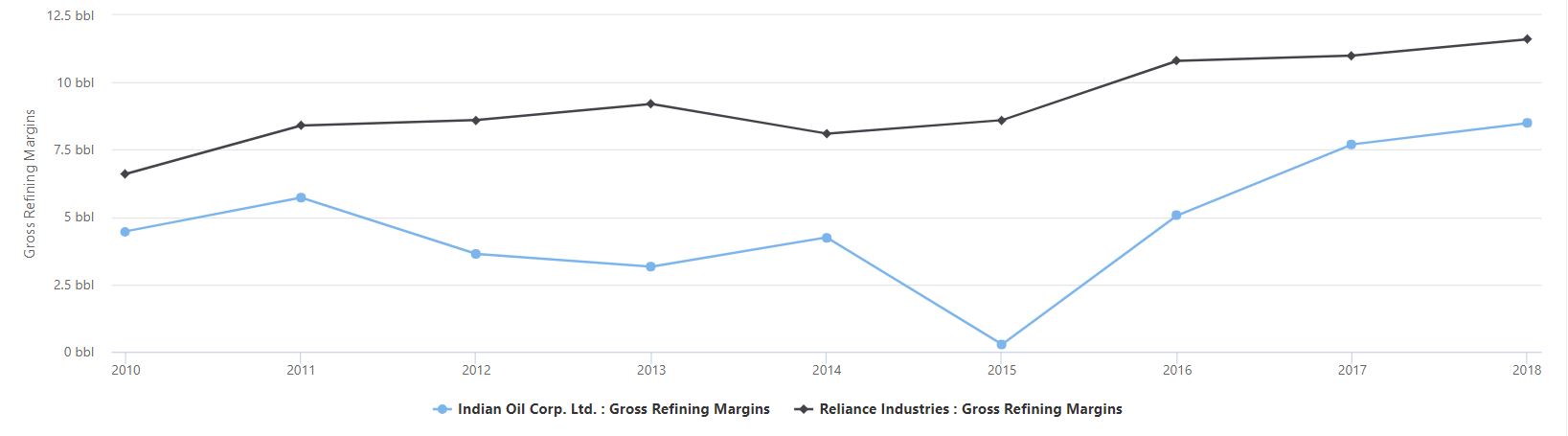

Take for example – GRMs for refining companies improved by nearly US$3-4/barrel, several manufacturing industries such as Auto OEMs, Paints, Cement etc saw gross margins improve on an average by 300bps. Companies with strong brands, competitive advantages benefited even more – eg Eicher motors/Maruti (over 10% improvement in gross margins).

I believe that all this was made possible as companies absorbed all the benefits of benign costs and gave consumers little benefit on that. End consumer fuel price never really came down all this time despite overall price getting halved. Similar was the case with car prices, cement price or for that matter any other product at the end consumer level.

As input prices remain firm, I feel it will start hurting us as an economy going forward. Most sectors/companies will have two options

- Pass on the prices to end consumer and risk killing demand and potentially even lose market share, or

- Keep the prices where they are and maintain growth levels.

A clear example of this is visible in the Airlines space where all the players are now bleeding significantly, but none is willing to raise the prices lest they lose their customers. Similar is the case in cement, autos, paints etc. Take a look at the EBITDA margins for the three largest players in each of these segments below. All have lost significant margins, and if commodity prices remain firm this could be the case for more time to come.

At the end of the day someone has to foot the bill –

- if government subsidizes then it could lead to the nasty inflation problems of 2012/13,

- if consumers are asked to then there could be impact on demand,

- else if corporates do, it could lower profitability thereby impacting their valuations and worth.

PS – All data and charts in this post are made using DistrictD database.

Related Blogs

THE TECHIE FUND MANAGER!

Indian equity markets have grown at a rapid pace o....

Udit Garg

12/03/2017 12:00 AM

Enhanced Screen

Elections got announced few days back, yet will re....

Udit Garg

04/04/2019 12:00 AM